Get the free ratio current

Show details

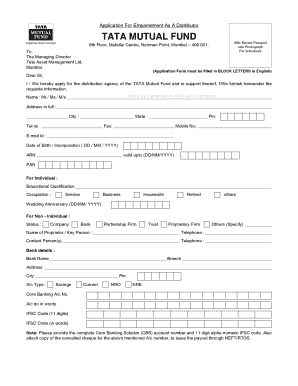

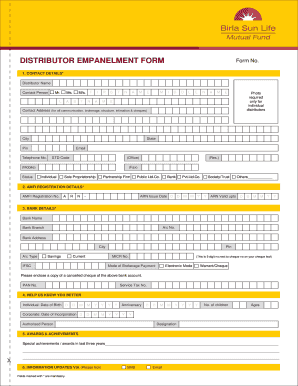

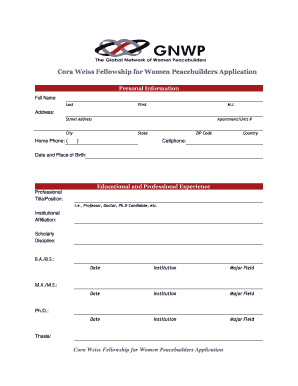

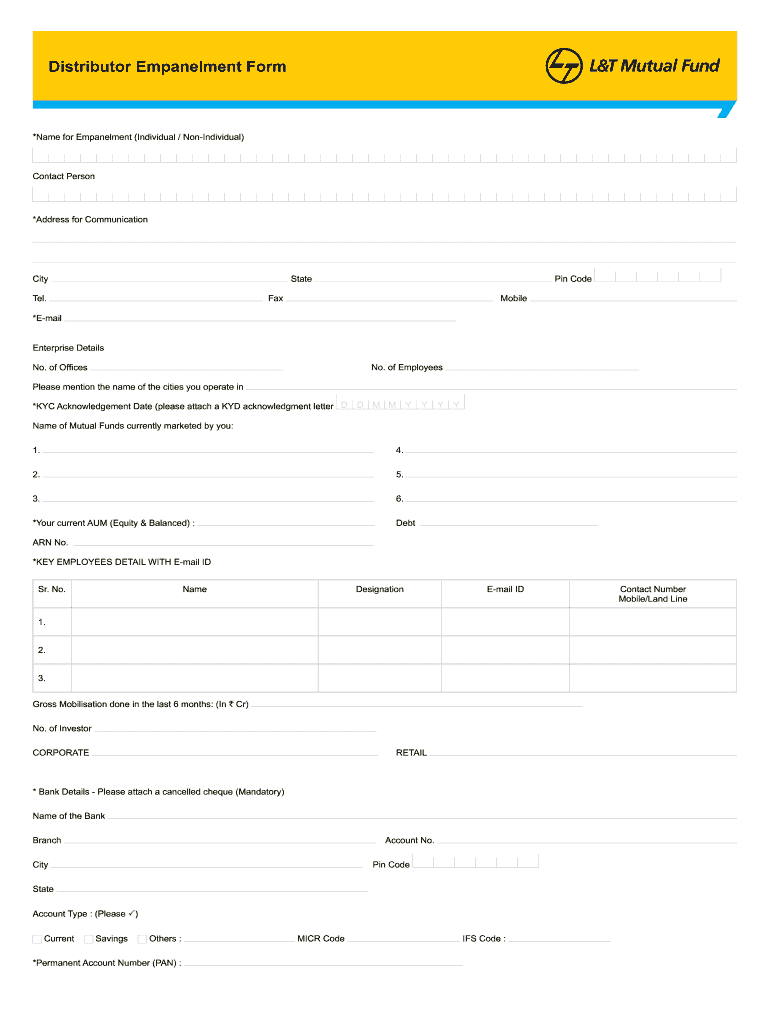

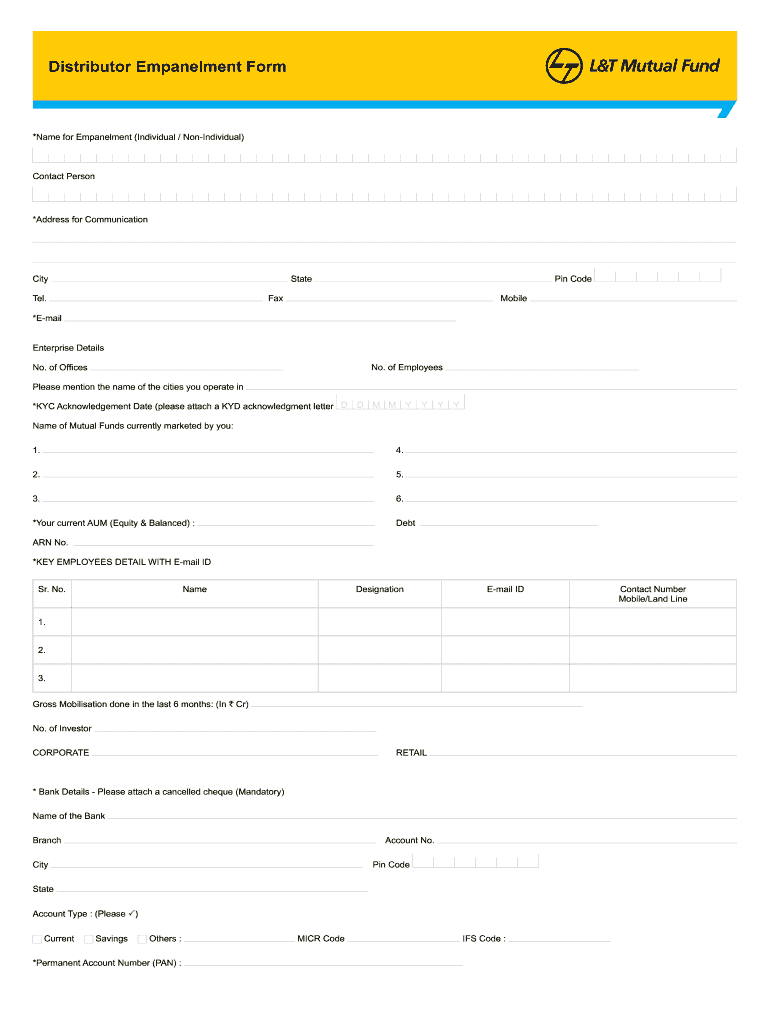

Distributor Embankment Form *Name for Embankment (Individual / Non-Individual) Contact Person *Address for Communication City State Tel. Pin Code Fax Mobile *E-mail Enterprise Details No. of Employees

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign l empanelment form

Edit your equity shares form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your l t mutual fund distributor login form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing online empanelment mutual fund online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit l empanelment form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out l t mutual fund empanelment online form

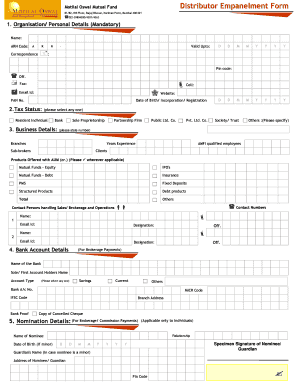

How to fill out L&T Mutual Funds Distributor Empanelment Form

01

Obtain the L&T Mutual Funds Distributor Empanelment Form from the official L&T Mutual Fund website or authorized branches.

02

Fill in the personal details accurately, including your name, contact information, and address.

03

Provide your professional details, such as your qualifications, relevant experience, and any certifications.

04

Specify your bank account details for transactions related to mutual fund distributions.

05

Attach any required documents, such as identity proof, address proof, and professional certifications.

06

Review the entire form for accuracy and completeness before submission.

07

Submit the completed form to the designated L&T Mutual Fund office or through their online submission portal, if available.

08

Note any reference number or receipt provided after submission for future follow-up.

Who needs L&T Mutual Funds Distributor Empanelment Form?

01

Independent Financial Advisors looking to distribute L&T Mutual Fund products.

02

Investment professionals seeking to enhance their service offerings through mutual fund distributions.

03

Individuals or firms aiming to become registered mutual fund distributors in India.

Fill

navi mutual fund distributor empanelment online

: Try Risk Free

People Also Ask about online empanelment in tata mutual fund

How do I empanel with AMC?

c) Corporate distributors obtaining empanelment with AMC is required to have at least 100 investors from non-associates within one year of empanelment or have average assets under management of at least Rs.

How to invest in L&T mutual fund online?

One can invest in L&T Mutual Fund online directly through Scripbox. Alternatively, they can invest in L&T MFs through the fund houses' website. Moreover, they can also invest in L&T Mutual Fund through any other online platform or mobile application.

How do I empanel my Navi mutual fund?

How to Invest in Navi Mutual Funds? Download the Navi app. You can get the app from Play Store or App Store. Explore and select fund. On the home screen, scroll down, click on 'Invest Now', explore funds & select the fund of your choice. Complete your KYC. Select SIP or lump sum. Select the amount and invest.

How do I get empanelled with AMC?

This undertaking would form part of his /her annual self-certification as specified in clause 12 hereinabove. c) Corporate distributors obtaining empanelment with AMC is required to have at least 100 investors from non-associates within one year of empanelment or have average assets under management of at least Rs.

How to invest in L&T mutual fund online?

KYC Required to Invest in L&T Mutual Fund KYC requirements are prescribed by SEBI. To invest in SEBI registered mutual funds, investors have to be KYC compliant. A KYC form will include identity information, address, financial status, occupation, and demographic information. You can get your KYC done with Scripbox.

How do I check my L&T mutual fund status with folio number?

L&T Mutual Fund Statement A missed call from your registered mobile number to 9212900020 gets you the total valuation on SMS, and statements on your registered email-id for all your folios and their corresponding schemes.

Does your L expire in BC?

Driving as a learner Your learner's licence stays valid for two years. If you need more time, you can renew your learner's licence by re-taking and passing the knowledge test.

What happened to L&T mutual fund?

L&T Mutual fund has been acquired by HSBC Mutual fund and all the L&T funds have been migrated to HSBC.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the l t mutual fund empanelment in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your shares equity in seconds.

Can I edit equity current ratio on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share l t mutual fund online empanelment on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete amc empanelment online on an Android device?

Complete your l t mutual fund distributor empanelment online and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is L&T Mutual Funds Distributor Empanelment Form?

The L&T Mutual Funds Distributor Empanelment Form is an application form designed for individuals or entities who wish to become authorized distributors for L&T Mutual Funds.

Who is required to file L&T Mutual Funds Distributor Empanelment Form?

Individuals or firms that intend to sell and distribute L&T Mutual Funds products are required to file the L&T Mutual Funds Distributor Empanelment Form.

How to fill out L&T Mutual Funds Distributor Empanelment Form?

To fill out the L&T Mutual Funds Distributor Empanelment Form, applicants need to provide personal details, business information, and relevant financial credentials as required by the form's guidelines.

What is the purpose of L&T Mutual Funds Distributor Empanelment Form?

The purpose of the L&T Mutual Funds Distributor Empanelment Form is to gather necessary information to assess the eligibility of distributors and to facilitate their registration with L&T Mutual Funds.

What information must be reported on L&T Mutual Funds Distributor Empanelment Form?

Information required includes personal identification, business registration details, financial background, experience in mutual funds, and compliance with regulatory norms.

Fill out your LT Mutual Funds Distributor Empanelment Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

L T Mf Online Empanelment is not the form you're looking for?Search for another form here.

Keywords relevant to l t mf empanelment online

Related to mutual funds distributor empanelment form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.